The volatility of oil prices today depends not only on the geopolitical situation, but also on the emergence and introduction of new technologies and facilitation of processes. There is still no clear definition of what digitalization is: works (Artificial Intelligence), services (Clouds computing) or goods (IIOT). Nevertheless, this word successfully attracts funding: companies are ready to invest, waiting for the birth of a new solution that will bring even more profit. Few conferences, forums and business meetings do without the word “digitalization”. In order not to get confused in a difficult choice and not to become hostages of venture financing, it is necessary to clearly understand what trends are emerging today in the field of digitalization of the oil and gas industry in Kazakhstan.

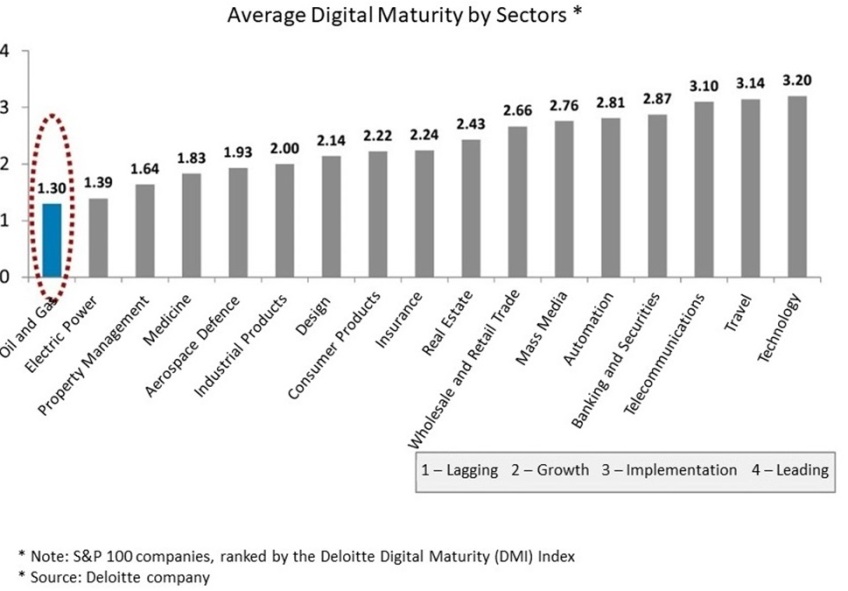

According to the analytical report of the World Economic Forum, digital transformation can increase the profitability of the oil and gas industry by $1 trillion. And the oil and gas inductry is one of the most non-digitalized (Fig. 1).

Fig. 1.

The oil and gas sector plays an important role in the economy of Kazakhstan, the share of the oil and gas sector in the state budget revenue was about 31-41% in 2015-2017. In the context of the current challenges, digitalization of the oil and gas industry can bring even more profit to the country’s economy. According to estimates of Petrocouncil.kz established under Atameken NCE and Kazenergy Association, the total volume of procurement of goods, works and services in the oil and gas industry of Kazakhstan in 2018 reached 6 trilliontenge ($16 billion), which is 30% more than in 2017. At the same time, the market of information technologies is more than $180 million, and the main part is accounted for the procurement by the three largest operators. However, more than 90% of this budget goes to foreign companies, software and hardware suppliers. Each company decides itself how to replace a foreign supplier by a local one.

Digitalization challenges

Challenges of digitalization century have revealed problems that are inherent only to the oil and gas industry. For example, it became clear that the technological and organizational readiness to implement technologies is lower here than in other industries. Large capital expenditures are necessary to introduce technologies, and the budget for digitalization is limited. Another challenge for the entire oil and gas sector was cybersecurity. But perhaps, the biggest “pain” of digitalization in Kazakhstan today is big data. Analysis of the reporting and monitoring system showed the problems of the existing system: the presence of two reporting channels and data discrepancy between the USS SUM and the IACOG; manual data entry; lack of reporting on crude (non-commercial oil); impossibility of rapid comprehensive cross-analysis of material balances of commercial and crude oil for each member of the industry. All these reasons became a reason to create the OAIS – Oil Accounting Information System.

Since January 1, 2020, entities operating in the field of oil and gas condensate production and turnover that have not equipped their enterprises with metering devices will not be able to operate in Kazakhstan. This is stated in Article 144 of the Law on Subsoil and Subsoil Use. According to the document, mining, transportation and refining companies must equip their infrastructure with oil metering devices and automatically transfer this data online (1 time per 24 hours) to the information system of the Ministry of Energy. The task of OAIS is to automate the daily collection, processing, storage and use of data on the amount of crude oil and gas condensate in circulation, prepared to be delivered to the consumer.

In addition, Kazakhstan’s oil and gas and oil service companies are concerned that, according to the Code on Subsoil and Subsoil Use, Article 75, Paragraph 6, the use of cloud technologies and, accordingly, computer-aided learning and artificial intelligence is possible only on the territory of Kazakhstan. It means that data analytics of the company the head offices of which are situated abroad should be made in Kazakhstan.

Both oil and gas and oil service foreign companies admit that they work on projects in Kazakhstan for a certain time, and therefore do not plan to develop specialized software and provide long-term investments in digitalization. Companies choose the strategy “we buy ready‑made solutions on the market”, and such solutions are usually provided by well‑known transcontinental brands such as SAP, Microsoft, OsiSoft and others.

At the conference themed “Digitalization of the oil and gas industry of Kazakhstan”, organized by Petrocouncil in Atyrau, NCOC CIO Ivo Aalbers said that operators are looking for personnel whose knowledge is at the intersection of new technologies, business efficiency and production processes. The strategic directions in which NCOC wants to see domestic companies are big data management, facilitation of storage and transportation processes.

The needs of the largest Kazakhstani operators in IT services are similar: companies are interested in digital twins, laser scanning technologies, artificial intelligence and data management. TCO Business Unit Architect Radomir Dorociak at the same conference noted: “TCO has two energy flows in Tengiz – hydrocarbon that goes through the pipes and the flow of data. Data is the assets of the company, their value lies in their ability to provide insight about something bigger. The more data is used, the more valuable it becomes. One of the projects, which, according to Radomir Dorociak, could be carried out by domestic experts is safety of vehicles. Today, TCO has 9,000 vehicles (trucks, buses, motor cars); 20,000 drivers; 176,000,000 km driven in 2018. Technology would make logistics in Atyrau region more secure.”

Are domestic digitalizers ready?

Surprisingly, the hubs, accelerators and incubators created in different cities of Kazakhstan do not focus on the transformation of production. However, it is the facilitation of production processes that brings the greatest financial and environmental benefits. That is why, in the West of Kazakhstan, it was decided to create Atyrau HUB, a platform that will stimulate research in the oil and gas industry, the digitalization of oil and gas production, transportation and refining processes, through the development of new technological solutions. Atyrau HUB will be located in the Higher College APEC PetroTechnic, which trains specialists in the oil and gas industry for the entire Western region.

The ecosystem created in Atyrau HUB will enable all stakeholders to find what they need: for subsoil users – optimization of processes, cost cutting and development of local content; for startups – mentoring, investment in development and expanding; for investors – increase in profits through scalable, marginal projects; for the state – development of innovation ecosystem, business development, new jobs and end of “brain drain” to other regions.

One of the most important tasks that could be solved with the help of technology – transparent, electronic procurement – has still not been realized. Single database – ALASH, established in 2015 in the framework of the Aktau Declaration at the initiative of the Ministry of Energy of the Republic of Kazakhstan and the three large oil and gas operators (KPO, NCOC and TCO) to provide automatic interaction between suppliers and operators, opened the market only partially. Today, the issue of creating an electronic procurement system for the oil and gas industry is still critical.

Another trend in the market of oil and gas digitalization in Kazakhstan is the involvement of system integrators capable of adapting existing solutions to the requirements of operators. The first Kazakhstani company that managed to occupy a high-tech niche in 2007 was Norsec Delta Projects – today’s leader in system integration. The preference of the system integrator echoes the strategy of companies – not to reinvent the wheel and to buy a ready‑made solution.

Another trend in the market of new technologies is the transfer of successful projects from other industries to the oil and gas sector. For example, well-known in Kazakhstan Flyworx, “Queen of drones”, that created the startup at the university, first provided GIS (geographic information system) services to farmers in agriculture, and then adapted the services to the needs of the oil and gas industry, having previously signed a contract with NASA.

Thus, the digitalization of the oil and gas industry in Kazakhstan, although it is at the very beginning, is already actively attracting professionals and technologies from around the world, which means that in the coming years, the Kazakhstani market of IT services is expected to move forward.

Raushan Naizabayeva, Petrocouncil Manager

Photo: freestockimages.ru