An interesting situation is developing in the motor fuel market of the country. On the one hand, consumption has increased, on the other hand, by the beginning of this year, the market had fuel reserves. At the same time, the fleet of registered cars in 2023 has grown by more than 20%. At the same time, both authorities and analysts predict fuel shortages in Kazakhstan already soon, and will have to import, for example, up to 1 million tons of gasoline per year.

“In general, the country has had a sufficient stock of oil products since last fall. In late winter and early spring, this stockpile increased to the highest ever (volume) in the country’s history. This led to a drop in imports of gasoline and diesel from Russia,” said Azat Murtazin, a leading analyst at the Argus price agency.

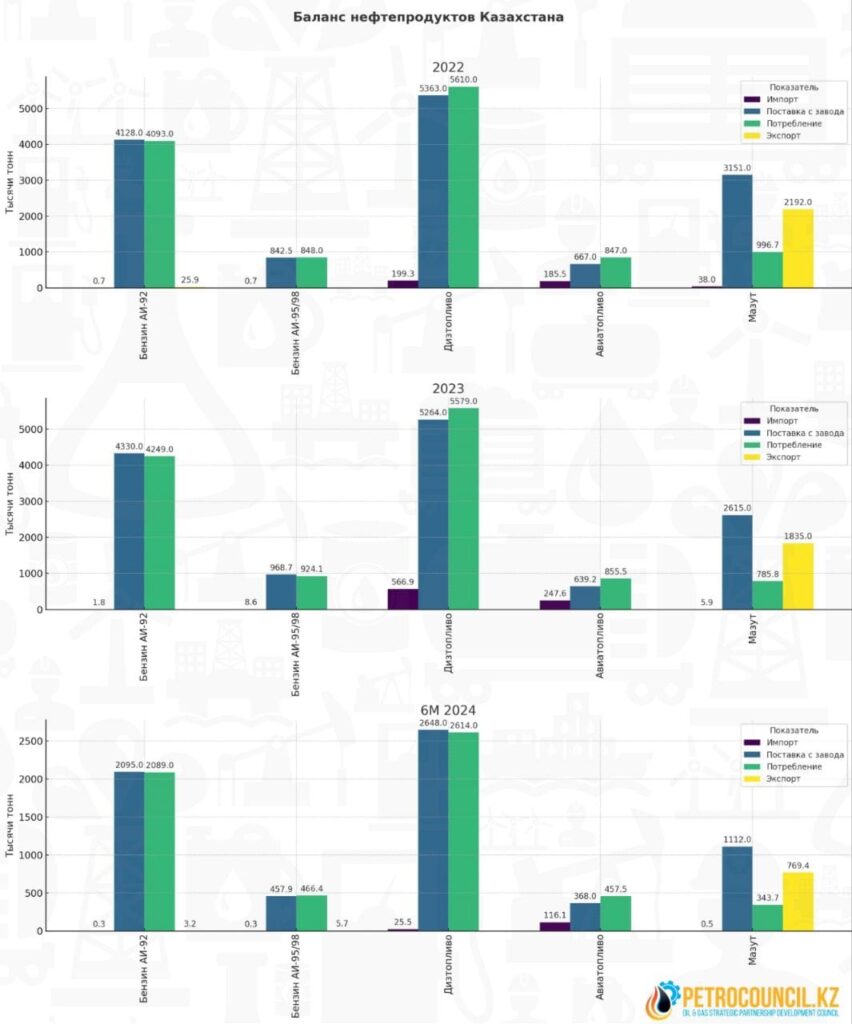

According to his data, last year the volume of AI-92 gasoline supplies from Kazakhstan refineries to retail consumers increased by almost 5% to over 4.3 million tons. Consumption of this brand increased by 4%, to more than 4.2 million tons. Deliveries of AI-95 and AI-98 gasoline increased even more – by 15%, to 968.7 thousand tons, and their consumption – by 9%, to 924.1 thousand tons. At the same time, the total production of petroleum products decreased by 3.6%, to over 14.8 million tons. (see Tables #1 and #2)

It seems that the “reform” (or redistribution) of the fuel and lubricants market initiated by the government is bearing fruit. Maybe the gradual increase of marginal wholesale prices also had an effect, which helped to increase gasoline supplies to the domestic market.

However, the situation with diesel fuel is still unfavorable. Its production decreased by 2% to over 5.2 million tons, while imports jumped almost three times to 567 thousand tons. At the same time, consumption even slightly decreased – by 0.5%, to 5.5 million tons. It is possible that the authorities, fearing a shortage of fuel during the fall harvest, gave market participants permission to import diesel fuel, which resulted in the formation of stocks, about which the Argus expert says.

In addition, the Ministry of Energy plans to establish new requirements for small oil refineries (refineries) to produce excisable products (gasoline and diesel fuel). Their volume by 2025 should be at least 25% of the total output, and by 2023 – 40%. According to the agency, today Kazakhstan has 24 mini-refineries, including four compounding plants, with a total processing capacity of about 800,000 tons per year. At the same time, it turns out, there are only 10 permanently operating mini-refineries.

However, these efforts are not enough to cover all domestic fuel needs. Azat Murtazin predicts that by 2030 the deficit of gasoline in the country may reach 1.7 million tons per year, diesel fuel – from 2 to 4 million tons, jet fuel – 500 thousand tons.

Meanwhile, his colleague Sergei Agibalov, vice president of consulting Argus, believes that Kazakhstan has a vast potential for participation in regional trade in petroleum products and the creation of a single market of the EAEU would only contribute to the realization of this potential.

Common market

In December 2018, the Supreme Eurasian Economic Council approved a program and action plan for the formation of a single market for oil and oil products in the EAEU by 2025, which involves harmonization of legislation, technical regulations, and trade procedures. But so far, the parties have not reached an agreement, and now it is very likely that the launch of the market will be postponed until 2027.

It seems that most countries are not ready to give up their markets completely to Russia, which even now is a monopolist in fuel supplies in the CIS and EAEU. For example, in 2023, gasoline exports from Russia covered more than 95% of Kyrgyzstan’s fuel needs and more than 90% of Armenia’s.

Last year, Russia supplied 610,000 tons of gasoline to Kyrgyzstan, 9,000 tons to Kazakhstan, 468,000 tons to Uzbekistan, 198,000 tons to Azerbaijan and 356,000 tons to Armenia. Belarus also supplied about 70,000 tons of fuel to most of these countries, including Russia itself.

The largest importers were Kyrgyzstan – 630 thousand tons, Armenia – 614 thousand, Uzbekistan – 493 thousand, Azerbaijan – 219 thousand. Kazakhstan imported from abroad about 9 thousand tons of gasoline, mainly AI-95/98/100.

Meanwhile, in 2023, the fleet of registered cars in Kazakhstan grew by a record 780 thousand units (in previous years grew on average by 100 thousand), sales of new cars amounted to 199 thousand, used imported cars – 81 thousand.

“The car fleet started to grow rapidly from November 2022 and only returned to normal growth rates in early 2024. The net increase of the fleet by 500 thousand cars was a one-off and, likely, reflects the change in migration flows,” the Argus expert notes.

It can be assumed that this is due to the arrival of migrants, for example, Russians who fled their country after the beginning of Russia’s military invasion of Ukraine. Recall that in that year, 406,000 Russians entered Kazakhstan in September alone (after the announcement of partial mobilization for the war), and about 3 million in total in 2022. And, although Kazakhstani authorities claimed that some of them left further to other countries or returned, a significant part seems to have stayed.

According to the expert, Kazakhstan’s car fleet remains “gasoline-powered”, and the high proportion of such vehicles will continue in the coming years. By 2030, the total vehicle fleet may grow to 5.9 million units, gasoline-powered cars will account for 84.6% of all vehicles (87.6% now). Therefore, the demand for gasoline in the country will continue to grow, also due to the development of road infrastructure and domestic tourism.

“Given the high utilization of refineries, the issue of expansion of existing refineries and construction of a fourth refinery remains relevant. If refining volumes remain at current levels and the vehicle fleet grows, the gasoline market may become deficient by 2030, which will again require imports of about 1 million tons. But more may be required,” says Sergei Agibalov.

Before the modernization of three large refineries, the republic imported the missing volumes from abroad. Thus, in 2015, gasoline imports amounted to 1.4 million tons. Then, as the capacity of the refineries expanded, the volumes decreased, and in 2018 about 500 thousand tons were imported.

From 2019 through 2023, the republic covered domestic fuel needs with its own production. There was even a short period in 2020-2021, when the country could export the surplus – 500 thousand and 100 thousand, respectively. However, in 2024, according to the Argus forecast, we will have to import 100 thousand tons of fuel. Further, to all appearances, the figures will only grow. By 2030, Kazakhstan will become dependent on imports again, buying up to 1 million tons of gasoline per year from abroad.

In 2019, there were 3.4 million gasoline-powered cars in the country. In 2022, the total number of registered cars was 3.9 million units, of which 3.5 million were gasoline powered. But in 2023, Kazakhstan’s car fleet grew sharply to 4.7 million units, of which 4.1 million were gasoline powered.

Argus forecasts that this year the total number of autos will rise to 4.8 million units, of which 4.2 million will be gasoline powered. In 2030, the figure will rise to 5.9 million and 5 million, respectively.

Electric vehicles will increase

Globally, the consumer shift to alternative fuel vehicles is already having a noticeable impact on gasoline and diesel demand. In the Nordic countries, the share of electric vehicles in sales exceeds 40%, although the fleet is being renewed more slowly (electric vehicles account for 5-10%).

In 2023, over 6.8 thousand electric vehicles were sold in Kazakhstan (3.4% of all sales), the share in the national fleet is still low (0.2%), but in Almaty (0.9%) the penetration rate is already close to the indicators of major cities in Eastern Europe.

Argus expects that during 2024-2030 there will be accelerated growth of the electric vehicle fleet in the EAEU countries due to the development of their own production facilities, preservation of customs privileges and rapid development of electric charging stations.

In Kazakhstan, the number of electric cars increased from 1 thousand units in 2019 to 8 thousand in 2023. It is expected that this year their number will reach 12 thousand, and in 2030 – 178 thousand, of which in Almaty – 68 thousand, Astana – 62 thousand, in other regions – up to 48 thousand. That is, electric cars will still be used mainly in large cities. (see table #4)

Why is the demand for gasoline growing?

The agency believes that prices for motor fuel in Kazakhstan are objectively low. The price of gasoline AI-95 is about $0.6 per liter, AI-92 – $0.44.

At the same time, the price of AI-95 is 17% lower than in Russia, where prices are currently subsidized by about one-third through the damper mechanism. Without the damper it would be about $0.9 per liter.

Compared to Uzbekistan, the price in Kazakhstan is 44% lower.

The expert notes that for our country, to some extent, the market benchmark, with many reservations, is the price of $0.9-1 per liter, where the lower boundary is the price in Russia without a damper, and the upper boundary is the price in Uzbekistan. This does not mean that prices should become like this, but rather that a mechanism of fair pricing should be developed, which will contribute to the development of Kazakhstan’s economy and balance the interests of all market participants, Argus believes. (see Table #5)

Analysts also attribute the growth of gasoline consumption to the increase in transit transport. Until 2022, transit transportation through Kazakhstan came mainly from Central Asian countries. The reversal of trade flows after the war in Ukraine led to a multiple increase in transit from both Central Asian countries and neighboring countries, including Iran and South Asian countries. At the same time, a significant part of cargo transportation is carried out by road transport.

The Ministry of Transport of the Republic of Kazakhstan estimates that in 2023, transit traffic by road through Kazakhstan amounted to 4.9 million tons. Perishable foodstuffs, consumer goods and equipment account for the bulk of cargo transported by road.

Improvement of road infrastructure and development of the West-East transport corridors, including the TRACECA (a program of international cooperation between the European Union and partner countries to organize the Europe-Caucasus-Asia transport corridor) and One Belt, One Road initiatives, are already creating a new transit reality in the region.

According to the agency, economic integration within the EAEU and the ongoing restructuring of logistics will remain the drivers of growth in transit flows through Kazakhstan and Central Asian countries in the 2020s. According to Argus estimates, by 2030 the transit of goods by road through Kazakhstan may grow to 11 million tons, more than half of the cargo flow will be formed by the countries of South Asia (within the framework of the development of the North-South corridor) and transit directions from Russia to the Far Abroad countries.

Continued difference in retail fuel prices between Kazakhstan and neighboring countries will contribute to the growth of transit refueling stations. By 2030, the demand for diesel fuel in this sector of the market may reach 0.67 million tons, exceeding 13% of total diesel fuel sales in the country. Higher prices and tighter controls on refueling of such vehicles will limit diesel demand in this market segment to 0.45-0.47 million tons, experts said.

In 2023, the average consumption of gasoline per 1 passenger vehicle in Kazakhstan was 1.24 thousand liters. At the same time in the Mangystau region due to the high share of LPG consumption this indicator is 0.77 thousand liters. Whereas in Almaty region it reaches 1.51 thousand, and in Astana and Akmola region – up to 1.52 thousand liters.

In Pavlodar region, due to the large consumption of quarry equipment, the demand for diesel fuel is noticeably higher than the average for the country. Also, high demand for diesel fuel is observed in Zhambyl, Kyzylorda, Aktobe and West-Kazakhstan regions, through which the international highway passes. (see Table 6)

At the same time, large volumes of fuel are exported from Kazakhstan to neighboring countries. In 2023, a total of 213 thousand tons of gasoline was exported from the country in this way: 106 thousand tons from Almaty region, 93 thousand tons from Zhambyl region, and 14 thousand tons from other regions.

In 2023, 61 thousand tons of diesel fuel was exported to neighboring countries, including 10 thousand tons from Turkestan region, 9 thousand tons from Kyzylorda region, 8 thousand tons from Zhambyl region, and 34 thousand tons from other regions.

Higher fuel consumption in border regions is partly due to “retail imports” to neighboring countries, primarily Kyrgyzstan and Uzbekistan, and refueling of vehicles in transit. They prefer to refuel in Kazakhstan, as the cost of fuel here is lower than in neighboring countries.

According to Argus estimates, in 2023 retail gasoline exports led to an increase in domestic demand by 210-215 thousand tons relative to the equilibrium level, while diesel consumption increased by 55-60 thousand tons. Cross-border flows affect the market balance within the country, but tighter customs control will prevent these flows from increasing in the future.

Gasoline consumption in Kazakhstan will grow by 6.4 million tons by 2030, or by 1.1 million tons compared to 2023. Due to the growth of transit flows, demand will increase by 100 thousand tons, exports to neighboring countries – 100 thousand, low prices – 600 thousand, organic growth will be 400 thousand tons.

Thus, export of gasoline to neighboring countries of Central Asia and Russia, and growth of transit through Kazakhstan will be important factors of additional increase in gasoline consumption in the country.

The growth in demand for gasoline by 2030 may lead to a transition from a balanced to a deficit market, when we will have to import up to 1.2 million tons per year. Shortage problems will also affect the diesel market.

The solution to the problems may lie in the construction of a fourth refinery or expansion of the capacity of existing refineries, as well as a gradual transition to market pricing, analysts believe.

Gasoline or meat

Low gasoline prices are sometimes presented as some kind of economic achievement or boon available to all Kazakhstanis. They are often seen as a proxy for inflation, if the cost of fuel affects the overall price level both directly and indirectly through increased logistics costs.

However, experts note that gasoline is an “inflationary significant” commodity, but its contribution to price growth is not as great as is commonly believed: spending on the purchase of gasoline AI-92 in the consumer basket in Kazakhstan is 1.9% of all spending of the population. Spending on beef, for example, is twice as high (4%). But despite this, food markets are much less likely to be subject to government regulation than the energy sector.

Subsidization leads to price distortions not only within a single sector, but also in the economy as a whole: demand for a “cheap” resource increase, while the relative prices of other goods are often higher than they would have been in the absence of subsidies. For example, the availability of beef increased by 45% between 2018 and 2024, while the availability of AI-92 gasoline, for which price regulation remains in place, increased by 95%.

Now Kazakhstan is already noticeably ahead of Russia and Eastern European countries in terms of gasoline availability, approaching the indicators of Italy and France. But, unfortunately, low prices for gasoline and diesel fuel do not necessarily translate into low prices for other goods. (see Table 7)

Table No.1. Balance of oil products in Kazakhstan, th. tons

| Fuel | 6m 2024 | 2023 | 2022 | |

| Gasoline AI-92 | Delivery from the factory | 2 095 | 4 330 | 4 128 |

| Importing | 0,3 | 1,8 | 0,7 | |

| Exporting | 3,2 | – | 25,9 | |

| Consumption | 2 089 | 4 249 | 4 093 | |

| Gasoline AI-95/98 | Delivery from the factory | 457,9 | 968,7 | 842,5 |

| Importing | 0,3 | 8,6 | 0,7 | |

| Exporting | 5,7 | – | – | |

| Consumption | 466,4 | 924,1 | 848,0 | |

| Diesel fuel | Delivery from the factory | 2 648 | 5 264 | 5 363 |

| Importing | 25,5 | 566,9 | 199,3 | |

| Consumption | 2 614 | 5 579 | 5 610 | |

| Aviation fuel | Delivery from the factory | 368 | 639,2 | 667 |

| Importing | 116,1 | 247,6 | 185,5 | |

| Consumption | 457,5 | 855,5 | 847 | |

| Fuel oil | Delivery from the factory | 1 112 | 2 615 | 3 151 |

| Importing | 0,5 | 5,9 | 38 | |

| Exporting | 769,4 | 1 835 | 2 192 | |

| Consumption | 343,7 | 785,8 | 996,7 |

Main consumers: gasoline – retail chains, diesel fuel – retail chains, agricultural enterprises, Kazakhstan Temir Zholy JSC, mining and metallurgical complex (MMC), aviation fuel – airports and airlines, fuel oil – Power plant and MMC.

Table No. 2. Production of petroleum products in Kazakhstan, th. tons

| Product | 6m 2024 | 2023 | 2022 |

| Gasoline | 2 559 | 5 326 | 4 970 |

| Diesel fuel | 2596 | 5159 | 5231 |

| Aviation fuel | 367,4 | 637,8 | 665 |

| Fuel oil | 954,1 | 2 326 | 2 818 |

| Вакуумный газойль | 190,3 | 203,8 | 267,3 |

| Битум | 276,7 | 647,6 | 774,7 |

| Heating fuel | 35,9 | 91,2 | 90,1 |

| Gas carbon | 239 | 401,8 | 499 |

| Paraxylene | 115,4 | 18 | 76 |

| Benzol | 23,2 | 25,2 | 6,5 |

| Total | 7 357 | 14 837 | 15 398 |

Import forecast for 2024: diesel fuel – 229 thousand tons, jet fuel – 200 thousand tons. All fuel is imported from Russia.

Table 3. Key indicators of the EAEU oil and oil products market, 2023, mln tons

| Russia | Kazakhstan | Belarus | Kyrgyzstan | Armenia | |

| Production | 531 | 90 | 1,9 | 0,3 | 0 |

| Export | 234 | 71 | 0 | 0,2 | 0 |

| Refining | 275 | 18 | 16 | 0,2 | 0 |

| Gasoline | 44 | 5,3 | 3,6 | 0 | 0 |

Table #4. Share of electric vehicles (EVs), % of total fleet, 2023

| Country | EV |

| Kazakhstan | 0,2 |

| Sweden | 10 |

| China | 6,2 |

| Germany | 4,7 |

| Armenia | 2 |

| USA | 1,6 |

| Italy | 1,1 |

| Uzbekistan | 1 |

| Poland | 0,3 |

| Belarus | 0,2 |

| Russia | 0,1 |

Table #5. Retail prices for gasoline AI-95, June 2024, $ per liter

| Country | Price USD$ |

| Czech Republic | 1,7 |

| Romania | 1,5 |

| Armenia | 1,4 |

| South Korea | 1,3 |

| India | 1,2 |

| Uzbekistan | 1 |

| USA | 1 |

| Kyrgyzstan | 0,8 |

| Belarus | 0,7 |

| Russia | 0,7 |

| Kazakhstan | 0,6 |

Table No. 6. Consumption of gasoline and diesel fuel per 1 car, 2023, thousand liters

| Cities and Regions | Бензин | Дизтопливо |

| Abai Region | 1,03 | 21,7 |

| Astana and Akmola Region | 1,52 | 19,2 |

| Aktobe Region | 1,03 | 25,8 |

| Almaty and Almaty Region | 1,51 | 12 |

| Atyrau Region | 1,38 | 19,8 |

| Eastern Kazakhstan | 1,03 | 21,7 |

| Zhambyl Region | 1,48 | 25,1 |

| Zhetysu Region | 1,51 | 12 |

| Western Kazakhstan | 1,01 | 24,1 |

| Karaganda Region | 1,18 | 23,4 |

| Kostanai Region | 1,01 | 24,8 |

| Kyzylorda Region | 1,16 | 25,6 |

| Mangystau Region | 0,77 | 11,3 |

| Pavlodar Region | 1,28 | 45,8 |

| Northern Kazakhstan | 0,81 | 21,9 |

| Turkestan Region | 0,98 | 15,1 |

| Ulytau Region | 1,18 | 23,4 |

Table #7. How much gasoline AI-95 or beef can be bought on a salary, 2023

| Country | Th. liters | Meat kg |

| Kazakhstan | 1 | 142 |

| France | 1,8 | 173 |

| Russia | 1,4 | 150 |

| Czech Republic | 1,1 | 202 |

| Romania | 1,1 | 158 |

| Poland | 1,1 | 199 |

| Belarus | 0,8 | 179 |

| Turkiye | 0,7 | 72 |

| Armenia | 0,6 | 70 |

| Kyrgyzstan | 0,4 | 60 |

| Uzbekistan | 0,4 | 54 |